billings

Exchange rate change on the invoice

Any foreign currency invoice must be converted to your domestic/tax currency. The conversion is made according to the average exchange rate indicated in Settings>System>Taxable source, on the last working day preceding the day when the tax obligation arises.

According to art. 19a sec. 1 of the VAT Act, the tax obligation arises at the time the service is performed or the goods are delivered.

In the CargoLink system, the invoice must contain the issue date and the execution date. Depending on the order in which the two defined dates occur, the system will set the rate at -1 business day from the earlier date.

Example below:

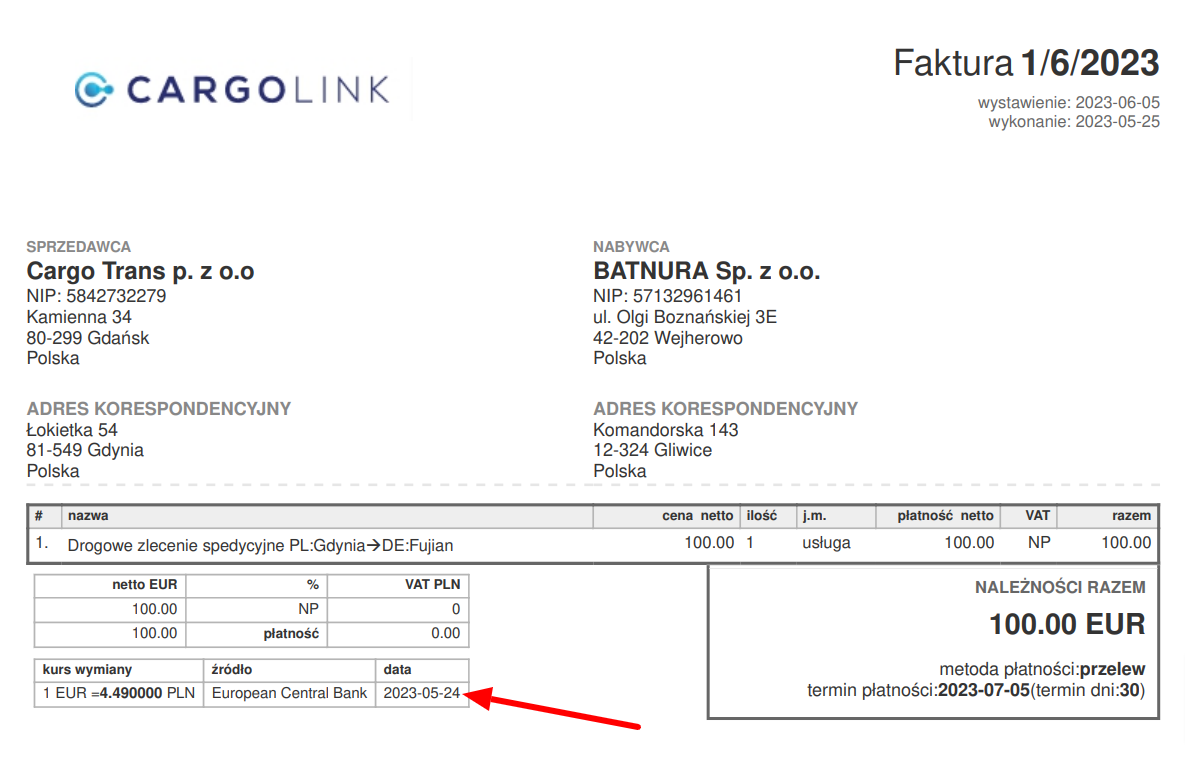

Invoice 1/6/2023 with the issue date 2023-06-05 and the execution date 2023-05-25

EUR exchange rate date 2023-05-24 (-1 day from execution date)

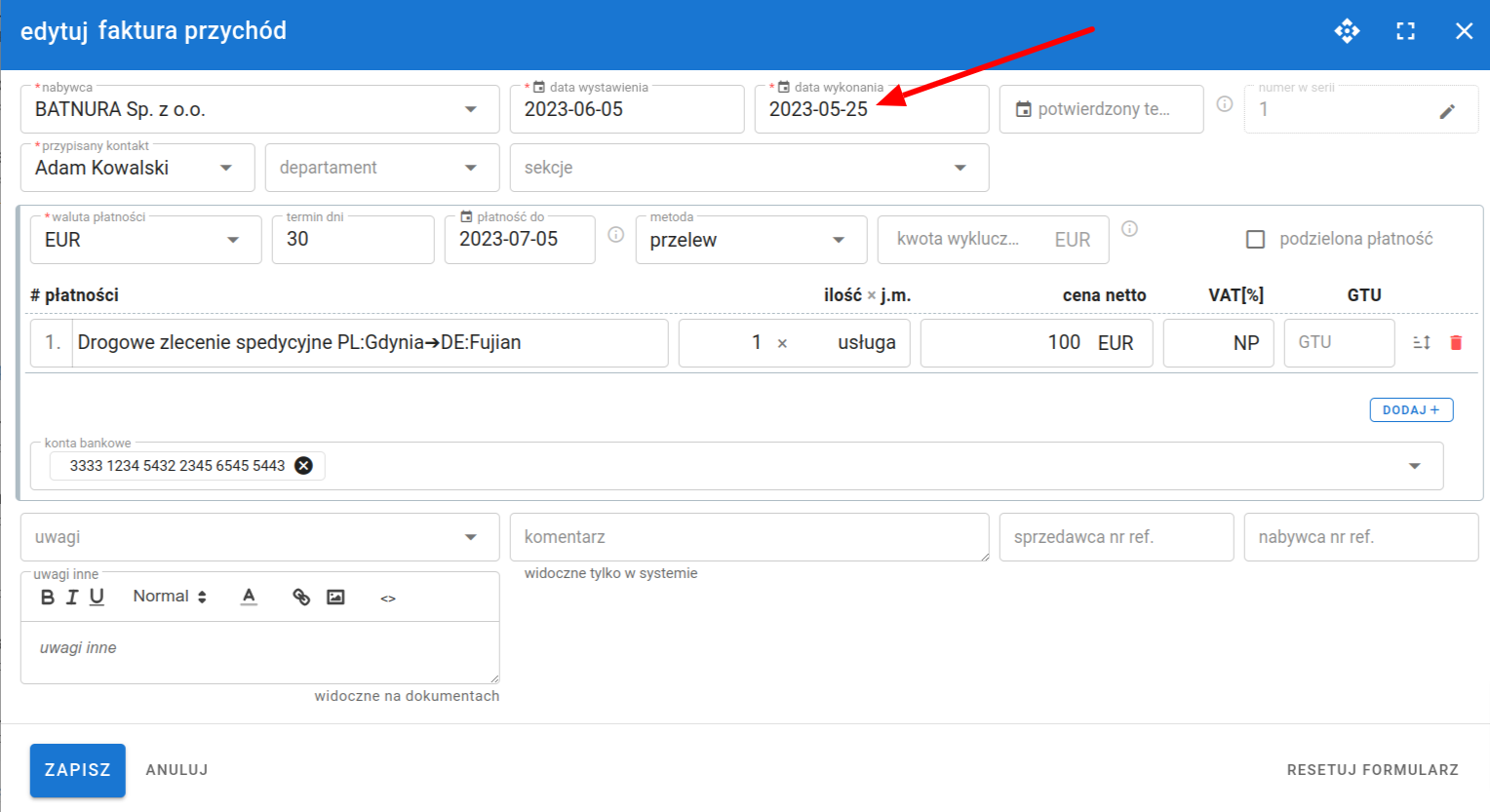

To change the execution date, go to the invoice edition by clicking the pencil icon.

Changing the exchange rate and VAT for individual items in the invoice is described in the article Manual edition of total net and total VAT in a billing